Process Mapping 101 – Defining and Refining Your Process

Despite the growing importance being placed around Business Process Management, a recent study found that only 4% of organizations actually measure...

Processing invoices is manageable enough when you only have a few vendors. But things start to become more complex as you work with more vendors. Manual processes can quickly turn into bottlenecks, which can delay payments and increase processing costs. They can also lead to costly accounting mistakes and invoices slipping through the cracks.

So how can you streamline and scale your invoice process? How can you free your accounts payable team from time-consuming tasks like manual data entry?

With the help of OCR (optical character recognition) technology.

In this article, we’ll explain what OCR invoice processing is and how it works. We’ll also look at how it can help streamline your procure-to-pay processes and the best software to get started with.

Click the links below to jump ahead:

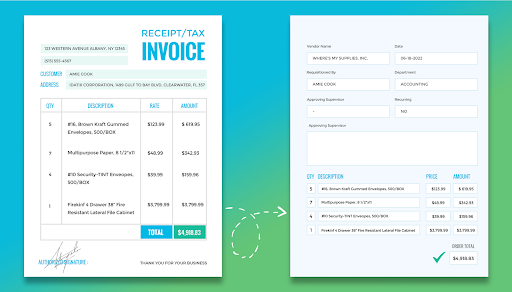

OCR invoice processing is the use of technology to digitally capture data from invoices. It converts data like invoice numbers, customer names, and totals into searchable text that automatically is entered into your accounting system for processing.

Without OCR technology, organizations have to manually enter and process their invoices. This often entails entering individual line items into an enterprise resource planning (ERP) system and checking them against internal documents like purchase orders to confirm their legitimacy.

Following these steps is simple enough for a few invoices. But multiply this process for hundreds or thousands of vendors, and you’ll end up losing countless hours on data entry alone. This can result in lost or missing invoices, late payments, and even higher susceptibility to fraud.

In contrast, processing invoices becomes much more streamlined with the help of OCR software like DocuPhase. Let’s look at how it works in the next section.

Invoices often come in different formats — paper, PDFs, Word documents, etc. Complicating matters even further is that some vendors may choose to email invoices, while others may send them through the mail.

Regardless of how your company receives invoices, you need to input each invoice line item into your ERP or accounting software. However, employees can end up spending an entire afternoon on this step alone.

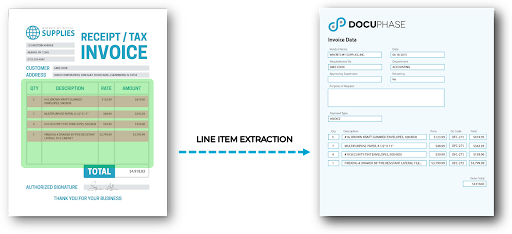

OCR software offers a more efficient way to process invoices. It uses advanced invoice capture technology to convert the data into a fully editable electronic invoice.

Invoices don’t need to be a specific format either. You can scan paper invoices or import digital files like PDFs. The software digitally converts text into machine-readable information and inputs the data into your ERP for the accounts payable team to access.

All of this happens with minimal human intervention. What’s more, it eliminates tedious manual data entry and frees your AP team to focus on more productive work.

DocuPhase’s OCR software uses a combination of machine learning and artificial intelligence (AI) to improve the speed and accuracy of invoice processing. As the system processes more data, it starts to recognize patterns. It gets better the more you use it.

The software includes configurable settings and rules-based validation that you can set to choose what data to capture. This helps ensure data quality.

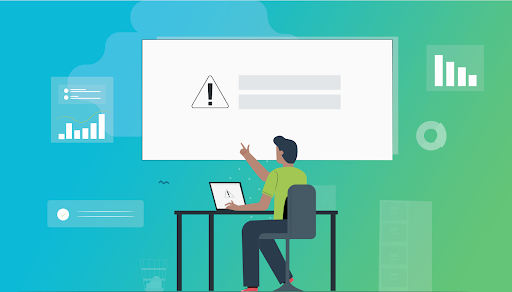

For example, as you start regularly working with certain vendors, you’ll have a good idea of what values to expect. You can tell the software to look for these values. If they’re not present or if there are other discrepancies, the software will flag the invoice for review.

Finally, once the data is entered into your ERP system, the accounts payable team will be able to access it. They won’t have to waste time searching for information.

Are you still processing vendor invoices manually? Here’s how OCR software can completely transform your AP processes and save your company valuable resources.

Few tasks are as tedious as data entry. In fact, 38% of employees say that manual data entry is among the most time-consuming tasks they perform in their roles.

Not only do you have to input invoice data into an ERP, but you also have to make sure that you’re placing them in the right fields — not an easy task when you consider that vendors tend to use different invoice templates.

OCR software can handle the bulk of data entry tasks in minutes rather than hours. It uses machine learning and AI to ensure the extracted data is entered into the correct fields.

When manually inputting data from an invoice into an ERP system, there’s always the risk of making data entry errors (e.g., inputting a “0” instead of a “9”).

Even a small error can result in overpaying or underpaying invoices, which can affect cash flow projections, impact financial decisions and hurt vendor relationships. In either case, you’ll need to spend time fixing these issues and reassuring vendors.

OCR software allows you to extract key data while reducing the risk of human errors. You can also set up rules that validate the data and flag any discrepancies. If any invoices have line items that are outside predicted values, you can automatically route them to a staff member for review.

GL codes offer an effective way to track transactions and get a clearer picture of where your money is going. However, manually assigning GL codes to all incoming invoices is a tedious and time-consuming process.

OCR software can automatically assign GL codes to your invoices, making it easier for your accounts payable team to track expenses and prepare financial reports.

Less time spent on repetitive tasks means that your accounts payable team can focus on more important work like following up with vendors and negotiating better contracts. These are the tasks that ultimately have a more positive impact on your bottom line.

Manual invoice processing can lead to higher overhead costs. Just to keep up with a growing number of invoices, you’d have to expand your accounts payable team.

Implementing OCR software significantly helps your company reduce invoice processing costs and even capture early payment discounts. Plus, you can pair the software with a document management system and save on storage costs.

DocuPhase’s OCR software lets you digitally capture and extract invoice data, so you can free your employees from tedious data entry. It also features robust automation features that enable you to streamline your entire procure-to-pay process.

Here’s a closer look at what you can do with DocuPhase.

Companies take 10 days on average to process a single invoice from receipt to payment.

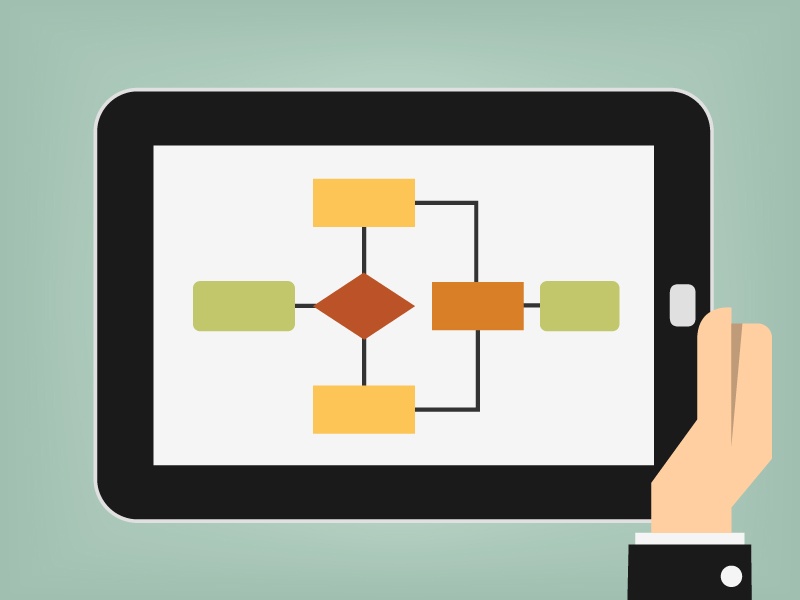

With DocuPhase, you can build robust approval workflows that route invoices to the right approvers. You can even create rules that route documents based on values.

For example, you can add a rule that routes invoices above certain values (e.g., anything over $10,000) to a senior executive for further review.

Real-time tracking enables you to monitor performance so you can quickly identify and address bottlenecks before they turn into bigger issues.

Three-way matching involves checking an invoice against a purchase order and a goods receipt note — an internal document that verifies a delivery.

Performing these steps helps protect against fraud, but manually checking every invoice against corresponding purchase orders and receipts is a painstaking process.

DocuPhase offers automatic three-way matching. The software matches invoice line items to existing purchase orders and receipts in your ERP. Automating these steps eliminates human errors and saves your team thousands of hours.

DocuPhase offers a robust document management solution that facilitates document retrieval and lets your company go completely paperless.

With features like auto-indexing and advanced search functions, your team will be able to quickly find and access the documents they need.

DocuPhase integrates with ERP systems like NetSuite, Dynamics, and more to ensure data accuracy and consistency across your organization. This means you won’t have to switch back and forth between different applications, as any edited data will automatically be updated.

Accounts payable teams can easily spend hours each day inputting invoices into an ERP. Not only does it keep them from more productive work, but it also increases the risk of human errors.

OCR software from DocuPhase eliminates data entry and saves your team from manually inputting invoices into an ERP system. By combining machine learning and AI, it gets better at processing data the more you use it.

Any organization that processes a large volume of invoices can benefit from OCR invoice processing technology. In fact, our customers see the highest ROI from our automation solution when they’re processing more than 1,000 invoices per month.

Ready to get started?

Request a demo today to see how implementing OCR software can help streamline your AP processes. Whether you’re processing dozens or hundreds of invoices, DocuPhase’s OCR software can scale to fit your needs.

Despite the growing importance being placed around Business Process Management, a recent study found that only 4% of organizations actually measure...

Regardless of the size of your organization or how you structure your accounts payable department (a team, a bookkeeper or an individual company...

Accounts Payable is an Essential Accounts Payable -- the department and the process -- are vital to an organization. The careful tracking of Accounts...