Optimizing Your Dynamics ERP for Efficient Payment Processing

Microsoft Dynamics is a dominant force in the ERP market. With a market share of 25.32%, it edges out even its closest competitors as the #1...

7 min read

![]() onPhase

:

Jun 14, 2022 8:00:00 AM

onPhase

:

Jun 14, 2022 8:00:00 AM

Are your old and clunky accounts payable and purchasing processes slowing down your business and damaging vendor relationships? Do your accounting teams struggle to compile data from different systems and teams?

With an automated procure-to-pay process, you can integrate accounts payable and purchasing into a single cohesive, fast, and 100% visible process.

In this article, we’ll break down exactly what P2P is with an example, showcase its benefits, and show you how you can implement it yourself without breaking the bank developing a custom tool for your company.

Use the links below to navigate the guide:

The procure-to-pay process is a system of integrating purchasing and accounts payable workflows to speed them up and free up capital.

Traditional accounts payable workflows include a number of manual steps and approvals that can slow down vendor payments. The P2P process relies on software solutions to integrate purchasing and accounts payable decision-making and eliminates superfluous steps.

The result is a smoother and faster procurement process and healthier vendor relationships.

But what exactly does this modern P2P process look like? Let’s break it down, step-by-step.

P2P includes most of the steps you’d normally see in a procurement process for any company:

While this still seems like a long and tedious multi-step process, with a modern P2P approach, the software is working behind the scenes to streamline the workflow. For example, it will automatically approve requisition orders under a certain amount or for certain items (like more paper for the printer).

It will also route each requisition and purchase order to the appropriate decision-maker depending on the type of product requested and the total cost.

This software-powered streamlining of the process is what makes P2P a preferred alternative to traditional procurement workflows.

A streamlined P2P process will speed up your procurement, improve the visibility of your cash flow, and reduce the risk of fraud.

Operation PAR, a provider of integrated addiction and mental health services, saw a 50% improvement in turn-around time for mission-critical supplies by implementing a smart P2P software solution to handle their purchase requisitions.

Before the switch, the company used email to communicate between offices and try to coordinate new orders. The accounting team then had to manually piece together everything and log it into their system.

With DocuPhase, PAR was able to create a standardized workflow for handling all purchase orders within the same system. All purchase requests automatically reach the appropriate manager for approval, no matter the office, and accounting has access to all the data in one integrated platform.

By integrating the processes into the same system, you can eliminate bottlenecks between teams and drastically speed up the workflows. And you can even earn early payment discounts, depending on your contracts with your vendors.

If you’re still making purchase requests through email or manually through your ERP (enterprise resource planning) software, you’re doing your finance teams a disservice.

An integrated P2P system will show you every purchase order in every stage (from pending approval to waiting on delivery) and gives you full visibility of upcoming expenses.

In other words, you’ll know exactly where every dollar is going and how much you’re going to be spending on supplies in the coming weeks so you can budget accordingly.

With better visibility, you also make it easy for your accounting team to audit any expenses after the fact. You can even build double-checks and audits into the process for purchases that exceed a certain limit in price or frequency.

And this is key because businesses need to make sure that every purchase they make is legitimate and that they’re getting the agreed-upon price and products from their vendors.

Experts estimate that around $2 trillion is lost to procurement fraud annually. That may sound like an exaggeration, but there’s a lot of white-collar crime that goes unnoticed.

A recent high-profile case involved an employee at Yale University making off with over $40 million in iPads and other tech equipment. The university didn’t notice that anything was off for several years.

With everything in one system, you can put preventative measures in place to minimize procurement fraud. For example, it would be easy to see if an employee ordered too much equipment or ordered replacements too frequently.

To explain how procure-to-pay works with an example, imagine a battery production manager who needs more lithium for the factory because of an unforeseen increase in demand.

This is what the process would look like with a traditional workflow where your purchasing department and accounts payable exist in separate ecosystems.

With a procure-to-pay system in place, you integrate both and automate parts of the process.

While it seems like it involves a similar number of steps, the amount of internal messaging and menial labor involved is completely different. That’s what helps speed up the process and ensure healthy supplier relationships — a paid supplier is a happy supplier, after all.

And with the right software, it’s not even a costly project to set up — you can get up and running in weeks.

Now that you understand the benefits of P2P let’s talk about how you can implement the procure-to-pay cycle in your business.

The first step is to find the right procure-to-pay solution for your business. Consider what your ideal software should look like, and ask questions about each of your options.

If you’re looking for an intuitive platform for end-to-end accounting automation, look no further than DocuPhase. Many companies have already used our platform to streamline their P2P processes.

For example, Alimera Sciences was able to reduce invoice processing time by 93% with DocuPhase’s Accounting Automation solution.

Once you have your software, it’s time to configure it. The first step is to map out your existing purchasing and accounts payable workflows. Process mapping — drawing a process visually step-by-step — is the best approach.

You can use a flowchart tool or do this on a whiteboard along with your AP and purchasing teams.

Here’s what’s important to note:

Once you have a visual representation of your process, it’s time to take advantage of your new software to streamline it.

Instead of manually messaging specific people (and then having to re-send the message if it went to the wrong person), you can use conditional routing to send each request to the right person.

You can create rules based on costs, product type, and other factors — if an expense is related to marketing rather than office supplies, it could go to the head of marketing instead.

You can even set up processes that automatically approve purchase requests beneath a certain threshold, for example, $500.

Beyond automatically routing how purchase orders get handled, robust procure-to-pay solutions can also help your team automate tedious tasks.

For example, your software should be able to handle automatic 3-way matching. This will lessen your AP team’s workload, speed up vendor payments, and let them focus on more important tasks.

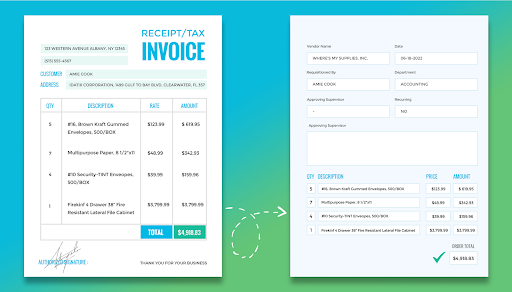

Another key feature is OCR invoice processing. Optical Character Recognition is software that can automatically digitize data from physical invoices or digital files like PDFs. You can set up conditional rules that check the validity of the data.

Whether or not these features are included depends on your service provider (DocuPhase offers both).

The most important step of the process is to ensure that your vendors get paid the correct amount on time.

With some P2P software, you can set it up to automatically pay vendors (if they exist in the system) after an invoice is approved using their preferred solution, for example, wire transfer.

This is the last stage of AP automation and is crucial if you want to take advantage of early payment discounts and rebates from your suppliers.

Plus, fast payments will also improve your supplier relationships and give you a more realistic image of your cash flow (without tons of expenses in a backlog all the time).

Many companies look at their accounts payable and purchasing teams as cost centers with little to contribute to the bottom line.

But an orderly and efficient P2P process can pay off in the form of early payment discounts and stronger vendor relationships. It also protects your company against costly procurement fraud, which is a risk for businesses of any size.

The first step toward streamlining how you handle purchasing and payments is to find the right software. Sign up for a free demo and see how DocuPhase can help you make the transition.

Microsoft Dynamics is a dominant force in the ERP market. With a market share of 25.32%, it edges out even its closest competitors as the #1...

1 min read

Quick Digest: Late payments and vendor frustrations? Procede Software Conference 2024 highlighted the power of automation in fixing these common...

Processing invoices is manageable enough when you only have a few vendors. But things start to become more complex as you work with more vendors....